AI Governance in Private Equity and Asset Management: Key Principles, Risks, Compliance [2025]

How do private equity (PE) and asset management firms use AI?

Permalink to “How do private equity (PE) and asset management firms use AI?”Summarize and analyze this article with 👉 🔮 Google AI Mode or 💬 ChatGPT or 🔍 Perplexity or 🤖 Claude or 🐦 Grok (X) .

Private equity and asset management firms are some of the largest high-impact data consumers in the world. According to V7 Labs, a typical VC firm typically reviews over one thousand applications in a calendar year.

Firms are increasingly using AI tools for quick and accurate investment calls.

“At least 80% of private equity workflows already rely heavily on technologies to source deals, conduct due diligence and manage portfolios; 95% of these firms are planning to multiply AI investments in the next 18 months.” - A World Economic Forum survey of firms managing a total of $3.2 trillion in assets

Forbes has already called this the era of AI-driven VC.

“The traditional VC model leaves enormous amounts of valuable information on the table. By leveraging AI and analytics, we can capture insights from our entire deal flow, not just the small percentage that results in investments.” - Sid Rajgarhia from First Round Capital on augmented VC decision-making

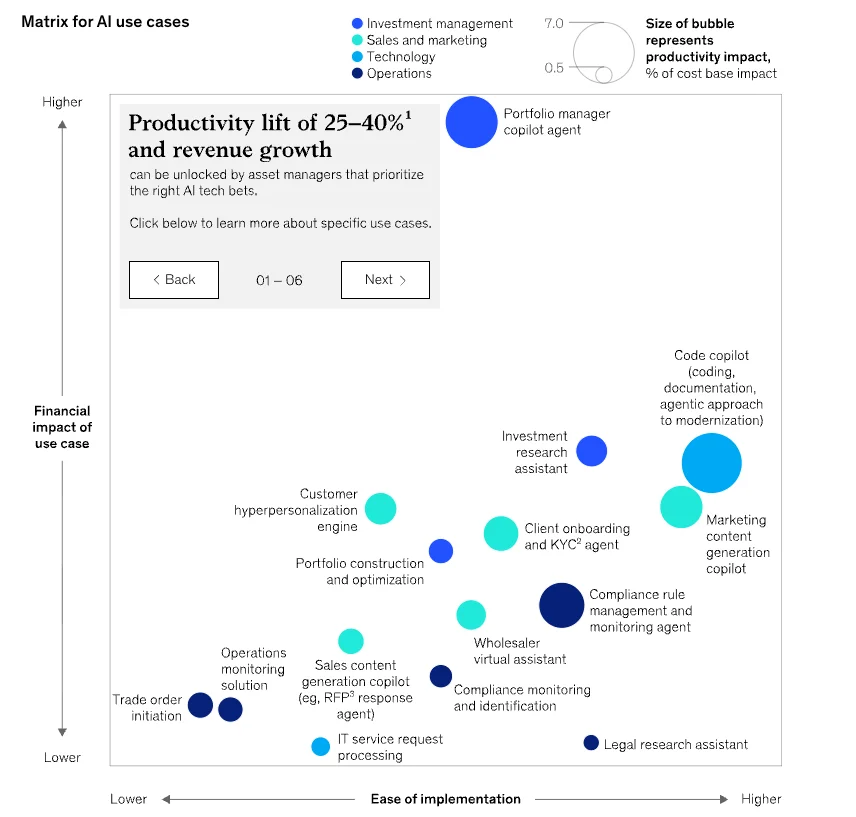

Top AI use cases in private equity and asset management

Permalink to “Top AI use cases in private equity and asset management”Analysts are already using GenAI-powered research assistants to synthesize data from earnings calls, financial reports, conferences, etc. to speed up insight generation, refine strategies, narrow investment options, and optimize portfolio construction.

Top AI use cases in private equity and asset management. Source: McKinsey.

The most common use cases for AI in private equity and asset management include:

- Deal sourcing and screening: Assess and shortlist deals that are worth making with the companies looking for private equity investors.

- Due diligence: Test and validate the value of the potential deals, using data supplied by companies and third parties.

- Competitive intelligence: Provide a comprehensive view of how a company stands up against its competition in the market. GenAI-powered applications can integrate and analyze various data types and sources–publicly-traded company filings, earnings calls, and social media posts.

- Fund and portfolio management: Oversee the day-to-day operations of a private equity or venture capital fund.

- Regulatory compliance: Interpret complex regulatory requirements, flag documentation gaps, detect anomalies, and flag potential non-compliance.

Getting maximum value from the above use cases and ensuring fair, legal, ethical AI use requires effective AI governance. Let’s explore the various elements of AI governance in private equity and asset management.

Why do we need AI governance in private equity and asset management?

Permalink to “Why do we need AI governance in private equity and asset management?”“We risk seeing misinformation, unintended discrimination or bias, manipulation of consumer sentiment and data security and privacy failures, all of which has the potential to cause consumer harm and damage to market confidence.” - King & Wood Mallesons report on “The Impact of AI on the Finance Industry”

The pressure to embrace AI is high — but so are the risks. AI promises faster due diligence, sharper investment theses, and better portfolio insights. However, these outcomes hinge on trust, and trust requires governance.

Private equity and asset management firms that deploy AI without proper governance have to grapple with potential risks and issues, such as:

- Misinformation and disinformation with AI models: GenAI can fabricate convincing but false insights, documents, or analysis

- The black box nature of AI models: Without proper lineage, monitoring, and explainability, AI-assisted decisions are opaque. It’s tough to justify investment decisions or defend them during audits.

- Sensitive data misuse: AI models trained on investor data, proprietary models, or confidential portfolio company information could inadvertently expose PII data.

- Reputational risk: From the SEC to the EU AI Act to OSFI E-23 in Canada, the regulatory spotlight is intensifying. Regulatory non-compliance can attract fines, penalties, and reputational damage.

- Ethics washing: As firms rush to adopt AI, there’s a risk of adopting shallow ethical frameworks that don’t hold up under scrutiny — exposing the firm to stakeholder backlash.

- Data integration across portfolios: PE firms must reconcile data from numerous portfolio companies, which often use disparate systems and reporting formats.

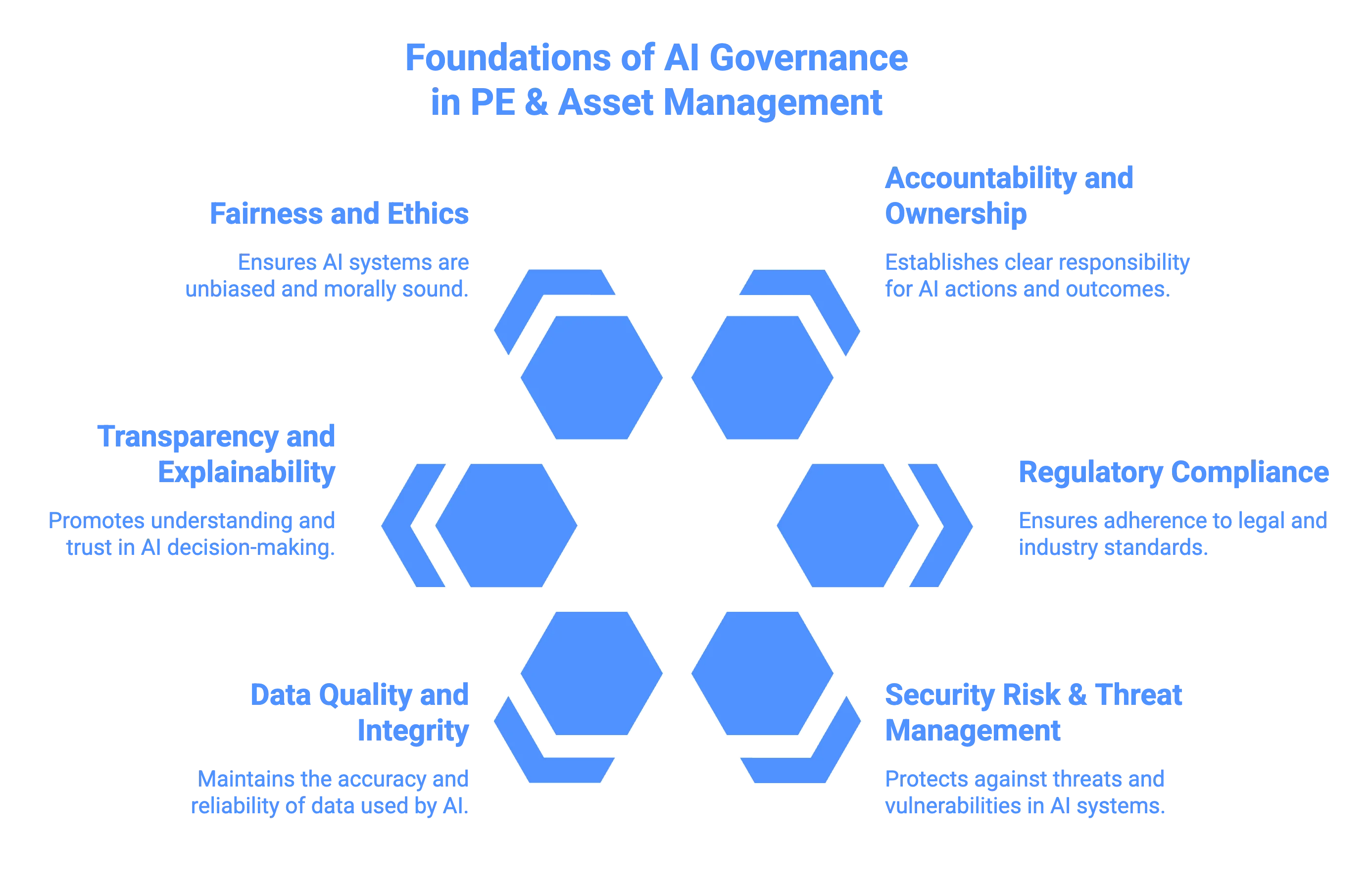

What are the six core principles of AI governance in private equity and asset management?

Permalink to “What are the six core principles of AI governance in private equity and asset management?”As firms in private equity and asset management adopt AI for everything from deal sourcing to risk modeling, strong governance is essential to ensure these systems operate responsibly and deliver trusted outcomes.

6 foundational aspects of AI governance in private equity and asset management. Image by Atlan.

The following six principles form the foundation of effective AI oversight.

1. Accountability and ownership of AI-led decisions

Permalink to “1. Accountability and ownership of AI-led decisions”Clear human accountability and ownership of AI-led decisions and their outcomes is critical—especially when they influence investment decisions, portfolio allocations, or trading strategies.

For example, if an AI model recommends divesting from a specific asset class based on market signals, a designated analyst or investment manager should validate the decision and remain accountable for its outcome.

Human-in-the-loop governance ensures oversight at critical decision points, especially those impacting capital flows or client trust.

2. Regulatory compliance

Permalink to “2. Regulatory compliance”AI tools in finance are subject to stringent rules — both sector-specific (like SEC, MiFID II) and AI-specific (EU AI Act, OSFI E-23). Compliance must be engineered into model development and deployment workflows.

Consider AI tools used for investment research. They must respect restrictions on insider information, accurate disclosures, and cross‑border rules among jurisdictions.

3. Security risk and threat management

Permalink to “3. Security risk and threat management”AI systems introduce new cybersecurity and operational risks, from model tampering to adversarial inputs and third-party vulnerabilities.

In 2024, FinCEN issued an alert on fraud schemes involving deepfake media–criminals alter or create fake IDs to circumvent identity verification and authentication methods. As AI adoption rises, so do threats. Proactive threat modeling and access control are essential.

4. Data quality and integrity

Permalink to “4. Data quality and integrity”AI model performance depends entirely on the quality of its training data. AI governance in private equity and asset management must ensure datasets are accurate, complete, timely, and free from bias.

Poor data (incomplete, biased, or outdated) leads to flawed insights and bad investments.

In 2023, Gemini’s precursor Bard provided inaccurate responses to queries during its demo, leading to a 7.7% drop in share prices and a $100 billion loss in market value. For PE and asset managers, the lesson is clear: governance starts with clean, governed data.

5. Transparency and explainability

Permalink to “5. Transparency and explainability”Decision-makers need to understand how and why an AI model reached a particular outcome, especially in high-stakes contexts like fund allocation or risk modeling.

Regulatory bodies increasingly expect models to be auditable and explainability is a key part of it.

If a model downgrades a portfolio company’s growth projection, investment committees should be able to trace the factors (inputs, weightings, assumptions) influencing that prediction.

6. Fairness and ethics

Permalink to “6. Fairness and ethics”Unchecked AI can amplify bias — filtering out opportunities, founders, or strategies based on skewed historical data. Governance ensures AI aligns with firm values and societal expectations.

For example, if an AI-powered screening model disproportionately filters out companies led by underrepresented founders due to biased historical data, it can lead to both ethical and financial blind spots.

Fairness audits and ethical guidelines must be built into model governance pipelines.

What is the role of metadata in ensuring solid AI governance in private equity and asset management firms?

Permalink to “What is the role of metadata in ensuring solid AI governance in private equity and asset management firms?”Strong AI governance relies on robust metadata. To manage risks like bias, non-compliance, and model drift, private equity and asset management firms need metadata that powers observability, auditability, fine-grained access control, and clear data ownership.

However, metadata in most firms remains fragmented, siloed, and often unusable. This limits governance efforts, especially when AI systems are deployed across diverse datasets and business units.

What’s needed is a unified metadata control plane — similar to a data lakehouse, but purpose-built for metadata. This architecture centralizes metadata across tools and teams, making it actionable for governance workflows.

A metadata control plane supports core governance capabilities, such as:

- Access to granular lineage (from source to model output across systems) for model explainability

- Clear ownership of data and AI decisions

- Auditing for all AI-related actions by logging, monitoring, and auditing all training, deployment, and inference events

- Automated policy enforcement for ethical and legal compliance – data privacy, masking, retention, usage rights and more

- Access to trusted, high-quality data with metadata-driven checks on essential data quality standards and measures

Platforms like Atlan provide this unified metadata control plane.

Using Atlan for AI model governance for private equity and asset management

Permalink to “Using Atlan for AI model governance for private equity and asset management”Built on a metadata lakehouse architecture, Atlan can help private equity and asset management firms automate governance, improve compliance, and build trust in AI systems.

Atlan’s control plane helps you ensure that all the data you use for the investment process is well accounted for and is traceable to the sources with capabilities, such as:

- Centralized AI asset management with smart asset discovery

- Cross-system, column-level lineage across your AI lifecycle along with AI asset versioning

- Policy management and compliance readiness with top-down policy coverage and automated enforcement

- Embedded workflows integrated with Jira and ServiceNow

Real stories from real customers: Automating governance at scale

Permalink to “Real stories from real customers: Automating governance at scale”

Modernized data stack and launched new products faster while safeguarding sensitive data

“Austin Capital Bank has embraced Atlan as their Active Metadata Management solution to modernize their data stack and enhance data governance. Ian Bass, Head of Data & Analytics, highlighted, ‘We needed a tool for data governance… an interface built on top of Snowflake to easily see who has access to what.’ With Atlan, they launched new products with unprecedented speed while ensuring sensitive data is protected through advanced masking policies.”

Ian Bass, Head of Data & Analytics

Austin Capital Bank

🎧 Listen to podcast: Austin Capital Bank From Data Chaos to Data Confidence

53 % less engineering workload and 20 % higher data-user satisfaction

“Kiwi.com has transformed its data governance by consolidating thousands of data assets into 58 discoverable data products using Atlan. ‘Atlan reduced our central engineering workload by 53 % and improved data user satisfaction by 20 %,’ Kiwi.com shared. Atlan’s intuitive interface streamlines access to essential information like ownership, contracts, and data quality issues, driving efficient governance across teams.”

Data Team

Kiwi.com

🎧 Listen to podcast: How Kiwi.com Unified Its Stack with Atlan

Let’s help you build a robust data governance framework

Book a Personalized Demo →Ready to accelerate AI innovation without compromising on compliance?

Permalink to “Ready to accelerate AI innovation without compromising on compliance?”AI governance in private equity and asset management is a regulatory and operational imperative. As firms use AI across sourcing, analysis, and decision-making, they must ensure full oversight of data and model behavior.

Every step of the decision-making process can be scrutinized by auditors for irregularities and misuse of data. Without proper governance, black-box models pose compliance, ethical, and financial risks.

A unified metadata control plane, like Atlan’s, provides the foundation to automate AI governance at scale, ensuring transparency, traceability, and trust across every decision.

Learn how Atlan can support responsible AI adoption in your firm.

FAQs about AI governance in private equity and asset management

Permalink to “FAQs about AI governance in private equity and asset management”1. What is AI governance in private equity and asset management?

Permalink to “1. What is AI governance in private equity and asset management?”AI governance in private equity and asset management refers to the frameworks, policies, and controls for AI models, making sure they’re transparent, explainable, and aligned with regulatory and ethical standards.

It covers areas like data quality, model accountability, risk management, and regulatory compliance to build trust and reduce operational and reputational risks.

2. How do private equity and asset management firms use AI?

Permalink to “2. How do private equity and asset management firms use AI?”Private equity and asset management firms use AI to:

- Screen and shortlist deals

- Perform due diligence

- Collect market intelligence using deep research features of AI models

- Operationalize fund and portfolio management using AI workflows

3. What are some of the key challenges in using AI for private equity and asset management?

Permalink to “3. What are some of the key challenges in using AI for private equity and asset management?”The key challenges of using AI for private equity and asset management are:

- Regulatory compliance

- Model decision explainability

- Data security and privacy

- Bias mitigation and discrimination reduction

- Transparency and accountability of AI-led decision-making

4. What is the role of data quality and lineage in AI governance?

Permalink to “4. What is the role of data quality and lineage in AI governance?”Both data quality and lineage are of utmost importance in AI governance as they ensure the model’s decisions are reliable and explainable.

Bad data quality, especially with high-impact investments in private equity and venture capital, can have disastrous consequences.

5. What are some common laws and regulations related to the use of AI in private equity and asset management?

Permalink to “5. What are some common laws and regulations related to the use of AI in private equity and asset management?”This is an evolving space but here are some of the common AI-related laws and regulations that apply to private equity and asset management firms:

- SEC Rule 17a-4 (for AI-generated communication recordkeeping)

- SEC Investment Advisers Act Rule 206(4)-7

- FinCEN Investment Adviser AML Rule

- EU AI Act Article 16

- SEC Private Fund Rules

6. What are the tools that can help you implement AI governance in private equity and asset management firms?

Permalink to “6. What are the tools that can help you implement AI governance in private equity and asset management firms?”Both data and AI governance are enforceable using the same tools, as the foundation for both the use cases is metadata, which is why a tool that leverages metadata activation for creating policy and governance workflows will work the best for implementing AI governance.

Share this article

Atlan is the next-generation platform for data and AI governance. It is a control plane that stitches together a business's disparate data infrastructure, cataloging and enriching data with business context and security.

AI governance in private equity and asset management: Related reads

Permalink to “AI governance in private equity and asset management: Related reads”- AI for Compliance Monitoring in Finance: Use Cases & Setup

- Unified Control Plane for Data: The Future of Data Cataloging

- Data Governance for AI: Challenges & Best Practices

- AI Governance: How to Mitigate Risks & Maximize Benefits

- The Future of AI Governance: Gartner’s Roadmap for Responsible AI Adoption

- 6 Essential AI Governance Principles for Responsible and Ethical AI Use

- What Is Data Lineage & Why Is It Important?

- Automated Data Lineage: Making Lineage Work For Everyone

- How AI-Ready Data Lineage Activates Trust & Context in 2025

- Data Catalog: Does Your Business Really Need One?

- What Is data governance & why does it matter?

- What is a data governance framework and why do you need one?

- What is data stewardship: Meaning, benefits, and its importance in data governance

- Data Governance Tools Comparison: How to Select the Best

- Data Governance Process: Why Your Business Can’t Succeed Without It

- Data Governance Maturity Model: A Roadmap to Optimizing Your Data Initiatives and Driving Business Value

- Federated Data Governance: Principles, Benefits, Setup

- Data Governance Committee 101: When Do You Need One?

- Data Governance Roles & Responsibilities: A Quick Round-Up

- Data Governance Councils in 2025: Everything You Need to Know

- Data Governance Policy: Examples, Templates & How to Write One

- 7 Best Practices for Data Governance to Follow in 2025

- 7 Must-Have Data Governance Certifications for 2025

- How to Drive Business Value with Data Governance