Self-Regulatory Organizations (SROs) Explained: How They Work and Why They Matter in 2025

Last Updated on: July 03rd, 2025 | 11 min read

Unlock Your Data's Potential With Atlan

Quick Answer: What are self-regulatory organizations?

Permalink to “Quick Answer: What are self-regulatory organizations?”Self-regulatory organizations (SROs) are non-governmental bodies that create and enforce industry regulations and standards within a specific industry, often under the oversight of a statutory regulator. SROs promote ethical conduct, market integrity, and professional accountability among their members.

Examples of SROs in the U.S. securities market include the Financial Industry Regulatory Authority (FINRA), the New York Stock Exchange (NYSE), and NASDAQ. They’re subject to oversight by the U.S. Securities and Exchange Commission (SEC).

Other examples include the Canadian Investment Regulatory Organization (CIRO) in Canada and the Chartered Institute for Securities & Investment (CISI) in the UK, which help maintain standards in their respective financial markets.

Up next, we’ll explore how SROs are formed, their core components, the benefits they offer to both regulators and the industry, and how metadata-driven tools can support compliance in self-regulated environments.

Table of Contents

Permalink to “Table of Contents”- Self-regulatory organizations (SROs) explained

- How are self-regulatory organizations (SROs) made?

- What are the key components of self-regulatory organizations (SROs)?

- What are some real-world examples of self-regulatory organizations (SROs) across industries?

- Why do self-regulatory organizations (SROs) matter to businesses?

- What role does metadata play in ensuring compliance with SRO rules and standards?

- Summing up

- Self-regulatory organizations: Frequently asked questions (FAQs)

Self-regulatory organizations (SROs) explained

Permalink to “Self-regulatory organizations (SROs) explained”Summarize and analyze this article with 👉 🔮 Google AI Mode or 💬 ChatGPT or 🔍 Perplexity or 🤖 Claude or 🐦 Grok (X) .

At their core, self-regulatory organizations (SROs) are independent industry bodies that oversee the conduct of their members by establishing rules, enforcing compliance, and promoting best practices. While they are not government agencies, many SROs operate under the supervision or delegated authority of a statutory regulator.

According to the U.S. SEC, SROs are “exchanges and associations that operate and govern the markets, and that are subject to oversight by the Securities and Exchange Commission (SEC).” Their responsibilities include:

- Monitoring market behavior and trading activity

- Investigating and disciplining members for improper conduct

- Referring suspicious trades or activity by nonmembers to the SEC

Canada’s Ontario Securities Commission (OSC) offers a similar definition – SROs are organizations empowered to regulate “the operations and standards of practice and business conduct of its members and their representatives.” This includes:

- Setting regulatory and investment industry standards

- Overseeing the conduct of member firms and registered professionals

- Acting in the public interest to protect investors and uphold market integrity

Though the scope and authority of SROs vary by jurisdiction, they serve as an essential link between formal regulation and day-to-day industry operations.

How are self-regulatory organizations (SROs) made?

Permalink to “How are self-regulatory organizations (SROs) made?”SROs are typically established through one of two pathways:

- Industry initiative: Market participants, such as broker-dealers or exchanges, may collaborate to create an SRO that enforces professional and ethical standards within their sector.

- Regulatory recognition or delegation: A statutory regulator (e.g., the SEC or OSC) may formally recognize an SRO or delegate regulatory responsibilities to it, acknowledging its expertise and capacity to oversee the industry effectively.

While many SROs are private entities, they are often subject to public oversight. Their rules may need to be reviewed and approved by the overseeing regulator, and their enforcement actions must align with public interest standards.

In some jurisdictions, SRO membership is mandatory for certain licenses or types of market participation. For example, in the U.S., broker-dealers must be members of FINRA to operate legally.

What are the key components of self-regulatory organizations (SROs)?

Permalink to “What are the key components of self-regulatory organizations (SROs)?”While the structure may vary slightly depending on the sector or country, most SROs share the following components:

- Membership base: Individuals or firms required to follow the SRO’s rules and code of conduct.

- Rulemaking authority: The ability to set operational, procedural, and ethical standards tailored to the needs of the industry.

- Supervisory and enforcement powers: The right to conduct investigations, impose fines or sanctions, and refer serious violations to statutory regulators.

- Internal governance: Committees, leadership structures, and review boards to maintain transparency and prevent conflicts of interest.

- External oversight: Ongoing review by a government regulator (e.g., SEC, OSC) to ensure the SRO’s rules and actions align with public interest and legal requirements.

SROs function as a hybrid model, blending private sector insight with public sector accountability. This structure enables them to respond faster to emerging risks, support innovation, and reduce the regulatory burden on government agencies.

What are some real-world examples of self-regulatory organizations (SROs) across industries?

Permalink to “What are some real-world examples of self-regulatory organizations (SROs) across industries?”Self-regulatory organizations (SROs) operate primarily in regulated industries like finance and securities, where government authorities formally delegate oversight responsibilities.

Here are some notable examples.

Financial Industry Regulatory Authority (FINRA) – United States

Permalink to “Financial Industry Regulatory Authority (FINRA) – United States”FINRA is a formally recognized SRO that regulates U.S. broker-dealers and registered representatives. It enforces rules, conducts exams, and monitors market behavior under the supervision of the U.S. Securities and Exchange Commission (SEC).

Canadian Investment Regulatory Organization (CIRO) – Canada

Permalink to “Canadian Investment Regulatory Organization (CIRO) – Canada”CIRO is Canada’s national SRO for investment dealers and mutual fund dealers. Formed in 2023 by the merger of IIROC and MFDA, it is recognized by the Canadian Securities Administrators (CSA) and regulates trading conduct and client protections.

Municipal Securities Rulemaking Board (MSRB) – United States

Permalink to “Municipal Securities Rulemaking Board (MSRB) – United States”The MSRB creates rules for dealers and advisors in the U.S. municipal securities market. While it does not directly enforce its rules, it operates under SEC oversight, with enforcement carried out by FINRA and other agencies.

The Chartered Institute for Securities & Investment (CISI) – United Kingdom

Permalink to “The Chartered Institute for Securities & Investment (CISI) – United Kingdom”CISI is not a formal SRO with enforcement powers, but it plays a quasi-regulatory role in the UK financial services sector. It sets professional standards, conducts certification exams, and enforces ethical codes for investment professionals.

CISI is recognized by the FCA for its role in training and credentialing but does not hold statutory enforcement authority.

Why do self-regulatory organizations (SROs) matter to businesses?

Permalink to “Why do self-regulatory organizations (SROs) matter to businesses?”Self-regulatory organizations (SROs) play a critical role in shaping how businesses operate within regulated industries. SRO membership is a great way to stay aligned with industry standards, reduce risk exposure, and maintain reputational credibility.

Three reasons why SROs matter to businesses:

- They bridge industry and regulation: SROs offer sector-specific guidance that complements the broader mandates of statutory regulators. This helps firms apply compliance practically within their daily operations.

- They help standardize conduct: By creating consistent rules and codes of ethics, SROs reduce ambiguity across firms, clients, and service providers.

- They reduce regulatory burden: Active supervision by SROs can ease the load on government regulators, creating faster resolution paths and more tailored compliance frameworks.

What are the key benefits of membership?

Permalink to “What are the key benefits of membership?”While some firms are required to join SROs to conduct business, membership also brings strategic benefits beyond regulatory necessity. Top benefits include:

- Credibility and trust: SRO membership signals a firm’s commitment to ethical conduct and regulatory alignment, building confidence with clients, partners, and the public.

- Industry validation: Being part of a recognized SRO demonstrates adherence to established best practices and elevates a firm’s professional standing.

- Standardized rules and practices: SROs offer clear guidelines that reduce ambiguity, ensure consistency across the industry, and create a fair competitive environment.

- Practical, expert-led oversight: Rules are created by industry practitioners who understand operational realities, making them more applicable than one-size-fits-all regulations.

- Access to education and guidance: Members benefit from training programs, certification paths, regulatory updates, and advisory resources that help teams stay compliant and competitive.

- Cost and efficiency advantages: By streamlining compliance requirements and offering shared infrastructure for oversight, SROs help reduce the complexity and cost of regulatory compliance.

- Efficient dispute resolution: Many SROs offer built-in arbitration or mediation services, helping members avoid lengthy and expensive legal proceedings.

- Policy influence and advocacy: SROs represent collective member interests in policy discussions and often invite input on rulemaking—giving firms a voice in shaping the regulatory environment.

- Market integrity and proactive risk management: SROs actively monitor member behavior, deter misconduct, and support early identification of risks—reducing reputational exposure and regulatory fallout.

What role does metadata play in ensuring compliance with SRO rules and standards?

Permalink to “What role does metadata play in ensuring compliance with SRO rules and standards?”For firms governed by self-regulatory organizations (SROs), compliance is about demonstrating how rules are being followed across systems, reports, and workflows. Active metadata makes that possible.

Active metadata refers to real-time, continuously updated information about your data—its lineage, access history, ownership, and usage. It forms the backbone of traceable, auditable systems that meet SRO expectations around control, transparency, and accountability.

A metadata control plane like Atlan puts active metadata to work by:

- Automatically mapping lineage across platforms like Snowflake, dbt, and Power BI

- Assigning clear ownership for regulatory regimes like SMCR or FINRA rules

- Enforcing metadata-driven policies that flag noncompliant data or access

- Capturing every schema or access change to create tamper-evident audit trails

- Aligning terms, definitions, and context to prevent reporting inconsistencies

By activating metadata across your data estate, Atlan helps firms operationalize SRO compliance—making controls visible, verifiable, and easy to scale across teams.

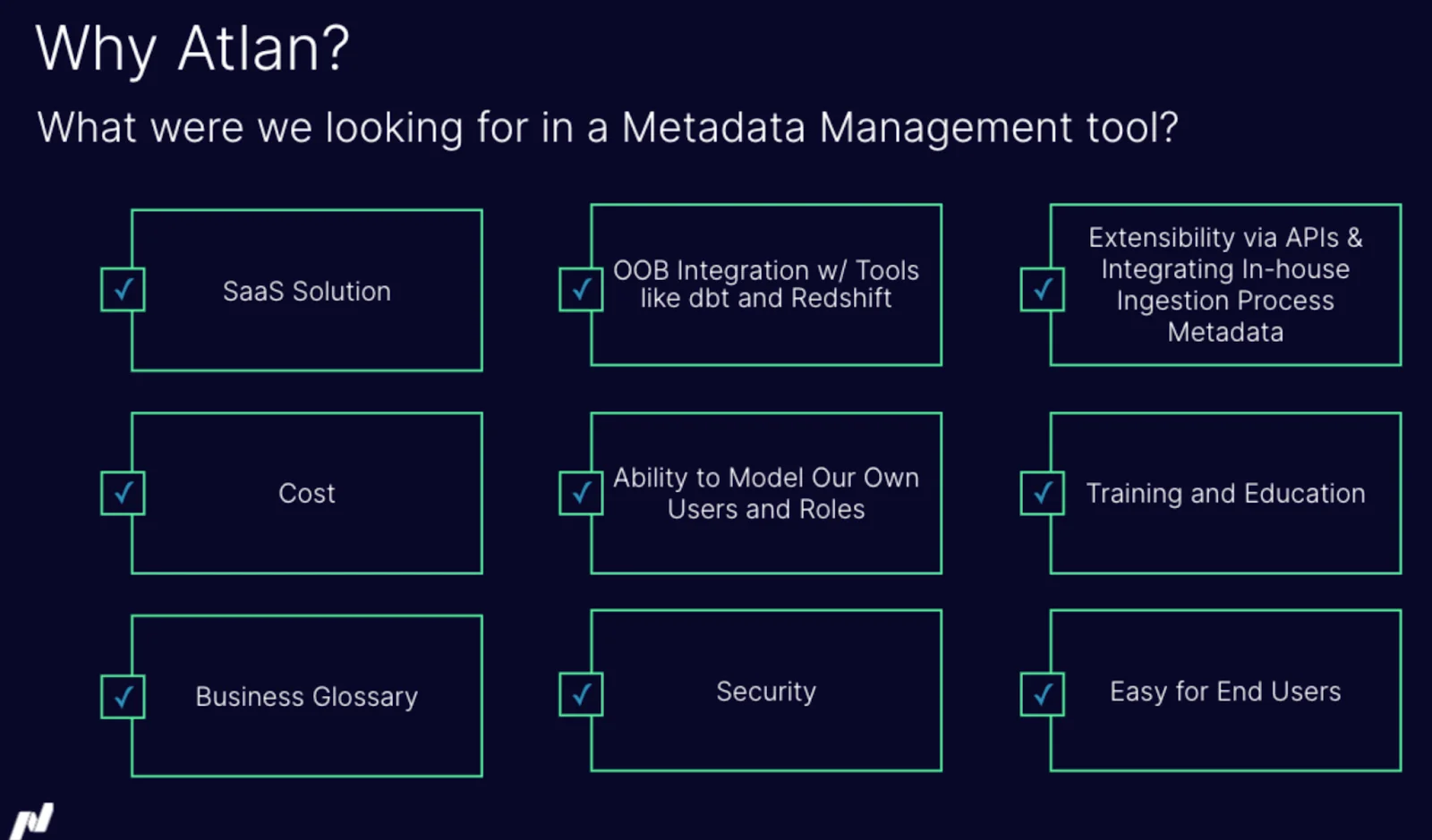

Why Nasdaq chose Atlan for active metadata management

Permalink to “Why Nasdaq chose Atlan for active metadata management”Nasdaq is the world’s second-largest exchange with $18 trillion in market capitalization and is home to the world’s most prestigious technology companies.

To improve data understanding and discovery, Nasdaq’s executive team wanted an active metadata management tool that helped users understand what data and tools they have at their disposal.

Without a platform like Atlan, data and capabilities would remain undiscoverable, reducing the potential return on investment from their data stack.

Choosing an active metadata management tool at Nasdaq - Image by Atlan.

“Whether raw data from their matching engine, or prepared metrics and visuals, significant time was spent on collecting context, slowing delivery on key insights and data products.” - The need for active metadata management at Nasdaq

With Atlan, Nasdaq managed to reduce time spent in data discovery by a third, with better and faster insights, leading to data-driven decisions. Atlan has become a ‘Google for data’ at Nasdaq.

In highly regulated environments—whether you’re a financial institution or a market operator like Nasdaq—active metadata becomes the foundation for scalable governance and continuous compliance readiness.

Summing up

Permalink to “Summing up”Self-regulatory organizations (SROs) are a defining feature of modern regulatory systems. They bring industry expertise to oversight, set shared standards, and promote ethical conduct, while easing the burden on statutory regulators.

For firms operating under SROs like FINRA, CIRO, or MSRB, compliance is foundational to business continuity, trust, and long-term competitiveness.

But as data volumes grow and oversight expectations intensify, firms can no longer rely on static documentation or manual governance to stay compliant. This is where active metadata plays an essential role by supporting traceability, accountability, and audit readiness at scale.

Active metadata transforms governance from an afterthought into an embedded capability and platforms like Atlan help operationalize it, making compliance with SRO standards not just achievable, but sustainable.

Self-regulatory organizations: Frequently asked questions (FAQs)

Permalink to “Self-regulatory organizations: Frequently asked questions (FAQs)”1. What is a self-regulatory organization (SRO)?

Permalink to “1. What is a self-regulatory organization (SRO)?”An SRO is a non-governmental body that sets and enforces rules, standards, and ethical guidelines for a specific industry. While independent, many SROs operate under the oversight or recognition of a statutory regulator (e.g. SEC, CSA).

2. How are self-regulatory organizations (SROs) different from government regulators like the FCA or SEC?

Permalink to “2. How are self-regulatory organizations (SROs) different from government regulators like the FCA or SEC?”Statutory regulators are public authorities created by law, with formal enforcement powers. SROs are typically industry-led organizations delegated with some regulatory responsibilities, but they remain private and often focus on setting standards, monitoring conduct, and self-enforcement.

3. Can SROs override government authorities?

Permalink to “3. Can SROs override government authorities?”No, SROs cannot override government authorities. While SROs establish and enforce their own rules, they typically operate under the direct oversight of a governmental regulatory body (e.g., the SEC for FINRA).

Their rules and enforcement actions are generally subject to review and approval by the government, which retains ultimate authority to intervene or set broader policy.

4. What are some well-known examples of self-regulatory organizations (SROs)?

Permalink to “4. What are some well-known examples of self-regulatory organizations (SROs)?”Examples include FINRA (U.S. broker-dealers), NFA (U.S. derivatives), CIRO (Canadian investment firms), and MSRB(U.S. municipal securities). These SROs operate under the oversight of agencies like the SEC or CFTC.

5. Are SROs mandatory for businesses?

Permalink to “5. Are SROs mandatory for businesses?”In many cases, yes. For example, U.S. broker-dealers must be FINRA members to operate legally. Some industries require SRO membership for licensing, while others treat it as a mark of professionalism and credibility.

6. Beyond compliance, what business benefits can we expect from strong SRO alignment?

Permalink to “6. Beyond compliance, what business benefits can we expect from strong SRO alignment?”Strong SRO alignment builds significant business trust and credibility, differentiating your organization. It fosters operational excellence through standardized practices, reduces litigation risk, and can even open doors to new market opportunities where SRO membership is valued. Ultimately, it contributes to a more stable, transparent, and reputable business environment.

7. How do self-regulatory organizations (SROs) support compliance and risk management?

Permalink to “7. How do self-regulatory organizations (SROs) support compliance and risk management?”SROs conduct regular audits, offer guidance, and enforce member standards—helping firms detect issues early, reduce misconduct, and maintain operational integrity.

8. What role does metadata play in meeting SRO requirements?

Permalink to “8. What role does metadata play in meeting SRO requirements?”Metadata provides the traceability and transparency needed for modern compliance. Active metadata helps firms map data lineage, assign ownership, track changes, and generate audit-ready documentation—critical for demonstrating compliance under SRO oversight.

Share this article

Atlan is the next-generation platform for data and AI governance. It is a control plane that stitches together a business's disparate data infrastructure, cataloging and enriching data with business context and security.

Self-regulatory organizations: Related reads

Permalink to “Self-regulatory organizations: Related reads”- What is Data Governance? Its Importance, Principles & How to Get Started?

- Data Governance and Compliance: An Act of Checks & Balances

- Data Governance and GDPR: A Comprehensive Guide to Achieving Regulatory Compliance

- Data Compliance Management in 2025

- Automated Data Governance: How Does It Help You Manage Access, Security & More at Scale?

- Enterprise Data Governance Basics, Strategy, Key Challenges, Benefits & Best Practices

- Data Governance in Banking: Benefits, Challenges, Capabilities

- Financial Data Governance: Strategies, Trends, Best Practices

- The Importance of Data Quality in Financial Services: 5 Reasons

- BCBS 239 Data Governance: What Banks Need to Know in 2025

- Financial Data Compliance Software: What Qualities Matter in 2025

- AI for Compliance Monitoring in Finance: Use Cases & Setup

- Unified Control Plane for Data: The Future of Data Cataloging

- Data Readiness for AI: 4 Fundamental Factors to Consider

- Role of Metadata Management in Enterprise AI: Why It Matters