Quick Answer: What is financial data governance? #

Financial data governance ensures that data used across a financial institution is accurate, secure, well-documented, and compliant with regulatory standards. It sets the rules for how data is managed, accessed, and trusted across teams and systems.

In the age of AI, where models rely on high-quality, explainable data, strong governance is essential for reducing risk, maintaining regulatory compliance, and enabling confident decision-making across the business.

Up next, let’s look at the current state of data governance in finance, key challenges, regulatory shifts, and what modern data teams need to succeed in 2025.

Table of Contents #

- Financial data governance explained

- Why do you need financial data governance?

- What is the state of data governance in the finance industry?

- What are some of the recent trends in finance data governance?

- How does Atlan’s metadata control plane support financial data governance?

- What are some success stories with data governance in finance?

- How can you implement financial data governance effectively? 10 best practices for finance data governance

- Financial data governance: Final thoughts

- Financial data governance: Frequently asked questions (FAQs)

Financial data governance explained #

Finance data governance encompasses the comprehensive oversight and management of all data stored and maintained by financial organizations. This sphere of governance doesn’t limit itself just to banks. It pervades various financial entities, including insurance companies, real estate brokers, and real estate investment trusts (REITs), among others.

Its significance extends beyond mere compliance.

Adopting robust data governance helps financial institutions adhere more closely to regulatory standards, thus potentially reducing regulatory fines. Furthermore, finance data governance cultivates deeper consumer trust by ensuring the sanctity and accuracy of their financial data and is essential for making accurate decisions.

According to Brianna Vandre, who leads data governance activities at GitLab:

Financial data plays a vital role in decision-making, risk management, and compliance. Given the sensitive nature of financial data, it is essential to have strong finance data governance in place.

Why do you need financial data governance? #

Finance data governance can help in dealing with:

- Regulatory oversight and non-compliance

- Data breaches

- Losses from poor data management

- AI risk and model governance failures

Let’s see how.

Dealing with regulatory oversight and non-compliance #

Financial organizations, given their handling of customer data, inevitably fall under regulations such as the General Data Protection Regulation (GDPR). The consequences of non-compliance aren’t merely reputational but can also be financially burdensome.

For instance, regulators fined Danske Bank in Denmark €1.3M after it admitted it couldn’t verify the completion of its procedures for deleting customer data that was no longer relevant.

Beyond GDPR, the industry is governed by numerous laws across the globe.

In the US, these include acts such as the Sarbanes-Oxley Act (SOX), the Gramm-Leach-Bliley Act (GLBA), and the cybersecurity regulations of 23 NYCRR 500.

Alongside these regulations, there exist industry standards such as PCI DSS, SOC 1, and more.

Data breaches and their ramifications #

Poor data management extends beyond mere compliance oversights or monetary penalties. It opens the floodgates to data breaches which can inflict severe damage on consumers.

Financial institutions like Equifax, which faced a significant breach in 2017, or Capital One in 2019, are just two noteworthy examples of fallout from data failures. Substantial fines and protracted court battles are often the result, underscoring the dire consequences of data mismanagement.

Read more → The ramifications of non-compliance on businesses

The high cost of poor data management #

Bad data isn’t merely an inconvenience. Poor data quality can lead to an average loss of USD $15M annually, according to Gartner.

For the finance industry, with its high stakes and tight margins, such losses can be catastrophic. Such was the case for the Commonwealth Bank in Australia which paid out more than half a billion dollars in fines related to money laundering and terrorism.

Senior management can be affected as well. The Desjardins Group, the largest federation of credit unions in North America, replaced two senior leaders in the wake of their 2019 data leak in an effort to restore trust and mitigate disruption.

AI risk and model governance failures #

As financial firms increasingly rely on AI and machine learning for credit scoring, fraud detection, and operational analytics, the risks tied to ungoverned models are growing.

Without strong model governance, firms face:

- Opaque decision-making and lack of explainability

- Regulatory non-compliance, especially under new frameworks like the EU AI Act and updated guidance from the OCC

- Data leakage, particularly when models are trained on sensitive or unclassified datasets

- Bias and fairness concerns, especially in high-risk applications like lending

To address this, data governance should extend beyond traditional data assets to include model inventories, training data documentation, lineage tracking, and performance monitoring. Without these safeguards, AI systems can quickly become a liability.

What is the state of data governance in the finance industry? #

The financial industry, with its deep reserves of consumer data and fast-expanding AI footprint, stands at a critical turning point for data governance.

While foundational roles and frameworks remain in place, new pressures—particularly from generative AI and advanced analytics—are accelerating change. Key developments shaping governance today include:

- The evolving role of Data Protection Officers

- A shift toward AI-ready, proactive governance

- Increased investment in governance platforms

- Mounting risks from model misuse, cyber threats, and legal uncertainty

Let’s see how.

The evolving role of data protection officers (DPO) #

Historically seen as an additional role, hiring a Data Protection Officer (DPO) has gone from option to mandate. Especially for sizable organizations, the GDPR has made the appointment of a DPO not just advisable but obligatory.

Notably, this isn’t limited to European companies. Global financial powerhouses, such as JPMorgan Chase, HSBC, and Goldman Sachs, have also integrated DPOs into their European operations.

With the rise of AI, the Data Protection Officer (DPO) has moved from compliance custodian to AI risk watchdog. Under regulations like the GDPR and the EU AI Act, financial firms operating in Europe must now evaluate not just data privacy risks, but also model-level risks around transparency, bias, and explainability.

A proactive approach to data governance takes center stage #

The industry’s stance has seen a marked shift from passive to active data governance. Instead of relying on manual, reactive procedures, there’s a drive towards being preemptive with respect to real-time security and compliance.

For instance, Citibank now uses predictive analytics to anticipate potential regulatory infringements, allowing them to address concerns before they become violations.

This forward-thinking approach, of showcasing compliance ahead of time instead of trying to justify it after issues arise, is a proactive shift significantly influenced by the standards set by GDPR.

More recently, proactive governance has expanded to include real-time governance of data pipelines, AI training workflows, and model behavior. This kind of governance relies on active metadata, automated policy enforcement, and observability layers designed to support both traditional data risks and emerging AI-related risks.

Increased investments in governance platforms #

From threat detection to GDPR compliance monitors, the technology stack is expanding toward specialized data governance and metadata management tools.

A notable inclusion is the modern data catalog, crucial for classifying data, tracing its lineage, and enforcing data governance policies.

However, as LLM use surges, data catalogs must evolve to become metadata control planes that unify lineage, classification, and access control.

Also, read → Why is metadata more important than ever for AI compliance?

Mounting risks from model misuse, cyber threats, and legal uncertainty #

The financial sector is undergoing significant change, embracing the latest tech trends and innovations. Yet, the journey isn’t smooth. Several specific challenges remain, especially concerning security risks, evolving tech uncertainties, and the complexities of the industry itself.

Cyber threats are particularly concerning, with Check Point reporting 50% YoY increase in attacks in 2022. These attacks bring to the fore the vulnerabilities of financial institutions in safeguarding data.

A study by KPMG in 2021 highlighted a concerning insight: a significant 43% of banking executives confessed that their organizations weren’t prepared enough to ensure data privacy.

Further complicating matters is the task of data management across large-scale financial institutions. For instance, operations as seemingly simple as data retention and deletion can morph into significant legal complications.

Deloitte’s James Fitzgerald and Rich Vestuto state in their report on legal considerations for data deletion that a “relaxed attitude towards a key component of information governance ignores the very real collateral costs of hoarding data.”

What are some of the recent trends in finance data governance? #

The financial sector is undergoing a dynamic transformation that’s reshaping the very pillars of data governance. Here are some noteworthy trends shaping finance data governance:

- Proliferation of regulatory frameworks

- A surge in compliance spending

- A push for unification of third-party solutions

- The maturity of digital infrastructure after 2020

- A rise in AI adoption since 2022

Let’s explore each trend further.

Proliferation of regulatory frameworks #

There’s a clear and identifiable move towards more stringent regulatory frameworks, inspired by the likes of GDPR. As reported by OECD, even countries beyond the European Union are keenly observing its success and have already initiated or are in the process of adopting GDPR-like models, both in the US and globally.

In addition to GDPR, frameworks like the EU AI Act, CPRA in California, and pending federal legislation in the US are influencing data governance mandates. Basel Committee updates to BCBS 239 in 2023 emphasized stronger controls on data lineage, aggregation, and governance, prompting many global and US-based banks to revisit compliance efforts.

A surge in compliance spending #

Recognizing the criticality of data governance, financial institutions are putting their money where their data is.

VMWare surveyed 130 financial sector CISOs and security leaders from around the world in early 2022. 41% of the financial institutions were headquartered in North America, 29% were in Europe, 16% were in Asia-Pacific, 12% were in Central and South America, and 2% were in Africa.

These institutions were set to increase their spending on compliance by 20% to 30% from 2021 to 2022.

A recent study by Deloitte highlights that compliance and remediation costs may go up with new regulations, such as open banking, Basel III Endgame, and debit card swipe fees.

A push for unification of third-party solutions #

The disparate nature of third-party communications has long been a bane for financial institutions. A 2022 report from Kiteworks shows that 22.5% of financial firms surveyed were keen on unifying management, tracking, and reporting mechanisms related to third-party communications.

The latest Gartner Magic Quadrant™ for Data and Analytics Governance Platforms report emphasizes a marked shift towards a unified platform for D&A governance and metadata management.

This need for a convergence of platforms will see the emergence of a metadata control plane as the unified platform for D&A governance, catering to diverse personas, teams, and use cases.

The maturity of digital infrastructure after 2020 #

Banking isn’t just about brick-and-mortar entities anymore. The shift towards digitizing assets and processes has seen many banking functions moving online.

JPMorgan Chase continued investments in digital banking platforms and tools in 2020. They expanded features in their mobile banking app, allowing customers to trade stocks and make investments right from their smartphones.

Bank of America reported a significant growth in its digital channels well into 2023, with 83% of households going digital.

HSBC undertook various digital initiatives in 2020 and 2021, including launching digital wallet offerings and expanding its mobile banking services.

A rise in AI adoption since 2022 #

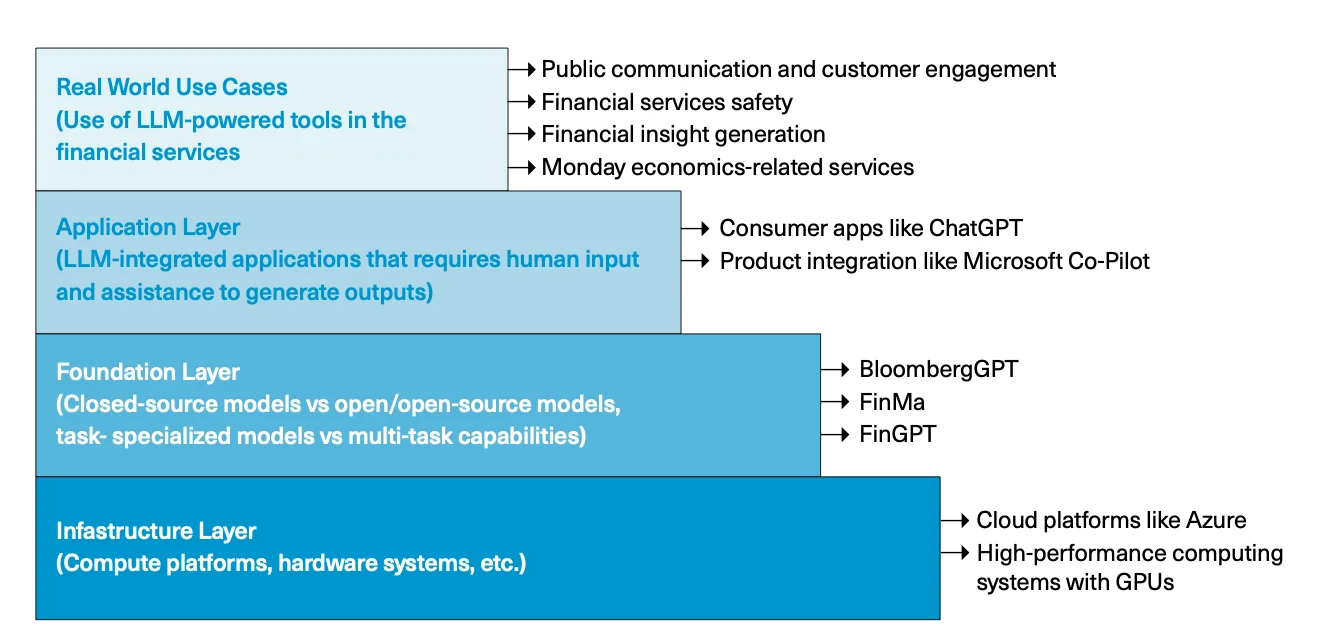

The period after 2020 reshaped data governance in finance through the rapid adoption of generative AI, foundation models, and predictive systems in core operations. What began as a digital leap evolved into an AI-led transformation, with far-reaching governance consequences.

Many financial institutions began embedding large language models (LLMs) and other machine learning systems into customer service, credit scoring, fraud detection, and advisory workflows.

LLM use in financial services across tech stacks - Source: The Alan Turing Institute.

While these tools boosted speed and insights, they also introduced new risks: opaque decision-making, model drift, data leakage, and lack of audit trails. These gaps put existing governance frameworks under pressure.

Also, read → Is your data AI-ready?

In response, global and US regulators began tightening expectations around AI and data governance. For instance, the EU AI Act, passed in 2024, classified financial services models used in credit scoring, KYC, and fraud detection as “high-risk,” triggering stricter requirements on training data governance, bias mitigation, and audit logging.

For many firms, this has meant rethinking metadata architecture, and adopting metadata control planes to bridge the gaps across tools, teams, and cloud platforms.

Also, read → Compliance metadata management 101 to build trust & get AI-ready

How does Atlan’s metadata control plane support financial data governance? #

Atlan’s metadata control plane provides a unified layer that connects metadata across your financial systems, platforms, and third-party tools—making governance enforceable and traceable at scale.

For financial institutions navigating complex regulations, Atlan supports key governance needs through:

- Granular access controls to ensure only authorized users and systems can access sensitive financial or PII data

- Data quality monitoring for preventing bias in training data sets

- Automated policy enforcement for ensuring data is only accessed by the right systems under the right circumstances

- Granular data lineage to trace data from ingestion to report or model, supporting BCBS 239 and model governance requirements

- Business glossary for bringing context and meaning to data assets, aligning teams on data definitions and regulatory classifications (e.g., KYC attributes, transaction types)

- Data product marketplace for ensuring that even from external data consumers or providers, there’s transparency and visibility in terms of data access and use

By embedding governance into data workflows, Atlan helps financial organizations manage risk proactively, meet evolving compliance expectations, and scale responsible AI adoption across domains.

What are some success stories with data governance in finance? #

Let’s look at three case studies highlighting the enormous benefits of proper data governance in terms of compliance, operational efficiency, and market responsiveness.

1. CSE Insurance #

CSE Insurance is a subsidiary of Covéa, a $20 billion global insurer in the United States. The insurance firm was modernizing its data stack with AWS, Amazon Aurora, Amazon Redshift, and Tableau.

They had to tackle issues with siloed data, ambiguous data definitions and metrics, and manual migration efforts. These issues could be resolved using a metadata management and data governance tool as it would help them set up a single source of truth for all users.

With Atlan, CSE Insurance was able to set this up within 6 weeks (instead of taking 3-4 months). Their data governance efforts became seamless as migrations to Atlan also included the original tags, descriptions, permissions, etc.

Moreover, finding data assets, getting complete context, and tracing their transformations via data lineage was just a click away — bringing down the data discovery time from a couple of hours to mere minutes.

Read more here: How CSE Insurance ships discoverable data products with Atlan

2. Austin Capital Bank #

Another example is Austin Capital Bank. They faced challenges querying across disconnected AWS and PostgreSQL databases, prompting the need to optimize query mechanisms for their new digital products model.

By integrating Atlan’s data catalog, the bank revolutionized its data query mechanisms. What once was a tedious, time-consuming process is now expedited, with customer data queries streamlined to mere hours.

This newfound efficiency wasn’t restricted to just data queries. It also enabled the bank to launch new financial products at a much faster pace. The FreeKick product launch is an example.

Austin Capital Bank aimed to launch FreeKick, a deviation from their usual products, before the crucial graduation season. However, their internal CRM wasn’t ready due to new infrastructure and transactional databases, which would have required Austin’s team to be constantly on-call to support client data queries.

Using Atlan’s “Insights” allowed for rapid and efficient client service support, without the need to understand SQL. This saved a lot of time and helped in rolling out the product on time.

Read more here: Austin Capital Bank’s Digital Transformation Powered by Snowflake and Atlan

3. Octane #

Octane Lending needed to democratize its data to enhance business intelligence and ensure a unified understanding of its data assets among different teams.

They faced challenges with siloed teams and tools, where different business segments had their own analytics approaches, leading to inconsistent interpretations and uses of shared data. The absence of centralized documentation further made it challenging to establish a common language and methodology for data, especially as remote work became prevalent during the pandemic.

By ensuring data availability to a wider audience through Atlan’s centralized, easily navigable platform, Octane did more than empower its analysts. It also ensured that the data insights they gleaned were holistic and comprehensive.

The impact on data governance outcomes was significant. For instance, the volume of questions in their internal Slack channel for data support dropped by 40% in just three months, translating to a savings of 200 hours per month.

Read more here: Octane Lending Saves 200 Hours per Month of Engineering Effort with Atlan

How can you implement financial data governance effectively? 10 best practices for finance data governance #

Proper implementation of data governance in the financial sector is not just about adhering to regulatory compliance. It’s about laying the foundation for enhanced decision-making, risk management, and operational efficiency.

Here’s a tailored approach for financial institutions:

- Set precise objectives: Start by outlining your primary goals, which can range from maintaining compliance and elevating customer relations to optimizing operations. A tangible target could be a bank’s intent to diminish data discrepancies by x% within a specific timeframe.

- Assess your data: Understand the breadth of your data - its location, users, and purpose. An initial step might involve a thorough review of all active databases and their respective operational roles.

- Delineate data domains: Organize your data into clear domains like customer or transaction data. Assign respective domain chiefs and pinpoint domain beneficiaries.

- Assign governance roles: Establish roles, from the overarching Chief Data Officer overseeing the strategy to data stewards ensuring quality and adherence within their domains.

- Formulate a governance framework: Design a structured approach detailing data handling processes, assignment of responsibilities, and protective measures for data.

- Incorporate relevant tools: Leverage essential technologies like data catalogs, quality tools, and protection software to amplify your governance plan’s potency.

- Establish performance metrics: Introduce clear metrics to gauge the traction and effectiveness of your governance approach, ranging from quality checks to business results rooted in data-driven endeavors.

- Promote continuous learning: Understand that data governance is evolutionary. Foster a culture of ongoing training and adoption.

- Track and refine: Consistently review and adjust your metrics, conducting recurrent checks to spotlight areas for refinement and optimization.

- Nurture a data-centric ethos: Cultivate an environment where data’s value is recognized universally, empowering all to base decisions on insights derived from this invaluable asset.

Financial data governance: Final thoughts #

Financial data governance is essential for reducing risk, meeting regulatory demands, and enabling responsible AI use.

The finance industry, already a labyrinth of complexities, faces its share of challenges, as discussed earlier. We also looked at the current state of data governance in finance and the trends shaping the industry.

The numerous success stories underscore the transformative potential of robust data governance. Meanwhile, the step-by-step approach detailed above is a great starting point to ensure successful implementation.

As finance continues to digitize and adopt AI, strong governance will be the foundation for secure, explainable, and compliant data-driven operations.

Financial data governance: Frequently asked questions (FAQs) #

1. What is financial data governance? #

Financial data governance is the set of rules, processes, and roles that ensure financial data is accurate, secure, traceable, and compliant. It covers how data is collected, classified, stored, and used across systems and teams.

2. Why does financial data governance matter? #

Financial data governance protects institutions from regulatory penalties, enables trustworthy reporting, and ensures data used in analytics and AI is reliable and auditable. Without it, even advanced systems like LLMs or predictive models can produce flawed or non-compliant results.

3. What’s the difference between data governance and data management in finance? #

Data governance defines the policies, roles, and rules for how data should be handled. Data management is the execution of those rules—storing, processing, and securing the data itself. Governance sets the standards; management carries them out.

4. What are the biggest financial compliance risks tied to poor data governance? #

Common risks include incomplete audit trails, inaccurate risk aggregation, untracked model inputs, and non-compliance with regulations like BCBS 239 or GLBA. These can lead to regulatory fines, reputational damage, or invalidated model outputs.

5. Who should own data governance in a financial institution? #

Ownership should be shared. The Chief Data Officer typically leads strategy, while business units, risk teams, and IT all have implementation roles. Clear data ownership at the domain level is essential for accountability.

6. How do I get executive buy-in for data governance initiatives? #

Tie governance efforts to business outcomes: risk reduction, audit readiness, faster reporting cycles, or AI adoption. Framing governance as a cost of delay rather than a cost center helps shift leadership perception.

7. How can I measure the success of our data governance program? #

Track metrics like data quality scores, policy enforcement rates, audit readiness, and time-to-insight. Also consider leading indicators like stakeholder adoption, lineage completeness, and reduction in manual exception handling.

8. How do I ensure our governance framework scales across business units and regions? #

Build a federated model with central standards and domain-specific implementation. Use metadata-driven controls and automation to maintain consistency while allowing flexibility for local regulations or operational needs.

9. What is the role of metadata in financial data governance? #

Metadata provides the context needed to govern data effectively, such as data lineage, ownership, classification, and access history. It enables automation, policy enforcement, and audit readiness, making metadata management central to modern financial data governance.