Data Governance in Insurance: Core Challenges, Business Benefits, and Essential Capabilities in 2025

Share this article

Data governance in insurance is the process of managing the availability, usability, integrity, and security of data used by insurers. It ensures the precise, consistent management of insurance-specific data to uphold accuracy and compliance.

See How Atlan Simplifies Data Governance – Start Product Tour

This article explores how insurance companies can benefit from effective data governance, covering key regulations, business outcomes, and the essential capabilities needed for proper implementation.

Table of contents #

- What is data governance in insurance?

- Why is data governance crucial for insurance companies?

- Data governance in insurance: What are the top challenges driving the need?

- How data governance supports positive business outcomes in the insurance industry

- Key capabilities that can drive effective data governance in insurance

- Case study: Implementing data governance policies and procedures at CSE Insurance

- Bottom line

- Data governance in insurance: Related reads

What is data governance in insurance? #

Data governance in insurance is a structured framework of policies, standards, processes, and technology for data management. Such a framework ensures data accuracy, security, accessibility, and consistency across the organization.

Data governance in insurance also defines roles and responsibilities to ensure that data is properly managed throughout its lifecycle.

For insurers, this involves managing diverse data sources—claims, customer profiles, risk assessments, policy details, and regulatory reports—to create a unified, reliable, and compliant data ecosystem.

Also, read → Unified control plane for data

Why is data governance crucial for insurance companies? #

Data governance is critical for an insurance company for several reasons, including:

- Eliminating data silos: A Deloitte report found that insurance data is “often siloed by function, system, and platform, and its utilization usually relegated to basic efficiency and cost control initiatives.” This makes it difficult to understand data, share it, and use it for decision-making.

- Ensuring regulatory compliance: Insurers operate under stringent global and regional data privacy, security, and reporting standards. These include GDPR, CCPA, and industry-specific standards such as IFRS 17, Solvency II, and NAIC guidelines. Data governance ensures adherence to these requirements by embedding compliance workflows into daily operations.

- Improving operational efficiency: Effective data governance streamlines data workflows, which reduces redundancies and ensures that data is consistent, accessible, and discoverable across departments. This cuts costs and improves collaboration and productivity.

- Enabling accurate underwriting: Quality data enables precise risk assessments, reducing underwriting errors and improving pricing models.

- Enhancing fraud detection and prevention: By maintaining clean, accessible data, insurers can better identify anomalies and flag fraudulent claims.

- Driving innovation and business growth: Data governance ensures that data is reliable and accessible, while also deterring poor data sharing and use. So, insurance companies can launch new products, enhance customer experiences, and leverage AI for advanced analytics, without breaking any data-specific regulations.

Data governance in insurance: What are the top challenges driving the need? #

According to Deloitte, even though data has been the industry’s lifeblood since the first actuary was hired, it lacks long-term strategic frameworks and the integration of systems to support data-driven decisions.

One insurer interviewed said, “we still treat data more like the plumbing,” while another described data as “more of a commodity.” - Deloitte Research

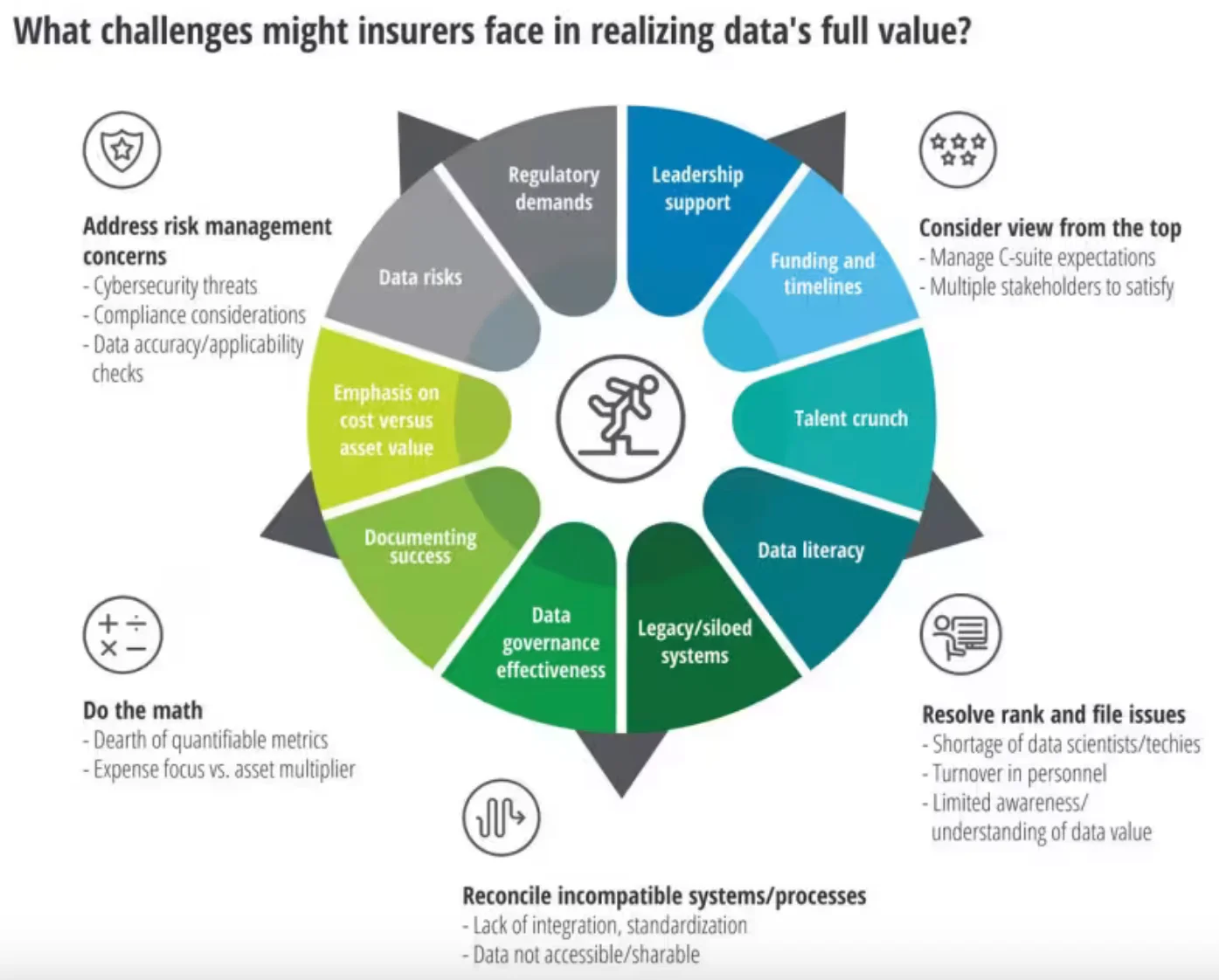

How ineffective data governance affects insurers - Source: Deloitte.

Key challenges that highlight the need for data governance in insurance include:

- Data silos and fragmentation: Insurers often manage data across multiple systems and platforms, creating silos that lead to inconsistent insights and delayed decisions.

Deloitte shines the spotlight on this challenge by emphasizing that data is “unlikely to deliver full value as long as information is stored in siloed and often incompatible legacy systems.”

- Legacy systems: many insurers still rely on legacy IT systems that are not designed for modern data integration and governance needs. This further exacerbates the problem of fragmented data.

According to Ed Sibley, Deputy Governor at the Central Bank of Ireland (CBI), “issues stem from a patchwork of legacy and newer systems that do not talk to each other, resulting in fragmented data that requires manual interventions and adjustments before it can be used.”

- Complex and rapidly evolving regulatory landscape: Insurance firms, in general, already have in place or are developing sound data governance arrangements. However, evolving regulations, especially as generative AI and ML become mainstream, require stricter audits, detailed reporting, and granular privacy controls.

- Increased data volume, variety, and complexity: As digitization and omni-channel experiences become the norm, insurers face challenges in managing, processing, and securing massive streams of data in various formats.

- Data quality issues: A Deloitte survey found that data quality was identified as a top challenge–the reliability, verifiability, timeliness, and relevance of data are among the many quality concerns. Inconsistent formats, outdated records, and duplicate entries can undermine decision-making and erode customer trust.

How data governance supports positive business outcomes in the insurance industry #

When implemented effectively, data governance can deliver transformative business outcomes, such as:

- Streamlined operations: Faster turnaround times for underwriting, pricing, and claims processing.

- Enhanced fraud detection: Leveraging AI-powered anomaly detection to flag potentially fraudulent insurance claims, such as multiple claims from the same policyholder or unusual activity.

- Faster claims processing: Data governance ensures claims data is complete and accessible, enabling faster and more accurate claim settlements. For instance, a motor insurer with governed telematics data can quickly verify accident details and process claims efficiently.

- Improved risk assessment: Accurate, governed data enables better analysis of customer behavior, risk factors, and market trends, improving the accuracy of risk models. For instance, a property insurer could use real-time weather data combined with historical claims to predict and price risks for natural disasters.

- Cost savings: Suppose your company discovers duplicate customer records, leading to wasted resources and potential errors in decision-making. Implementing a data governance framework would help identify and resolve data duplications, resulting in significant cost savings, improved efficiency, and more accurate decision-making.

- Culture of innovation: Data governance can unify systems under one roof, enabling seamless collaboration across technology, talent, and customer experience domains. This fosters an organizational mindset focused on innovation and collaboration.

- Revenue growth: Data governance enhances cross-selling and upselling opportunities while improving customer retention.

- Market share expansion and growth: Effective data governance drives greater competitiveness and customer acquisition through better data-driven insights. It also expands your scope to identify and capture new customer segments and niches.

Key capabilities that can drive effective data governance in insurance #

To successfully implement data governance, insurers should adopt technologies and processes that offer key governance capabilities, such as:

- Automated compliance management – audit trails, versioning, risk assessments, regulatory reporting

- Data contracts that establish clear agreements between data producers and consumers, upholding the accountability for data quality standards

- Effective metadata management that captures, describes, and manages all types of metadata, and automates metadata ingestion, classification, and sync for data tracking at scale

- End-to-end data lineage from source to destination (across systems, column, tables, transformations), helping banks understand where data originates and how it flows through their systems

- Granular access control, encryption, and personalized data masking and anonymization policies to proper data stewardship

- AI-assisted policy creation that helps analyze existing data, suggest appropriate policies, and automate policy updates

- Automated data asset documentation, tagging, and classification – especially for sensitive data like personally identifiable information (PII) – to drive data governance at scale

- Real-time incident alerts notify relevant stakeholders about policy incidents and breaches as they happen (and not years later)

- Easy integration with your data stack using out-of-the-box connectors for data products in your data stack (data sources, data movement tools, BI tools, etc.)

- Collaboration capabilities (threads, comments, alerts, mentions, user tagging)

- Easy deployment (across on-premise, public cloud, SaaS, multi-cloud, etc.), adoption, and quick time-to-value

Let’s see these capabilities in action at CSE Insurance.

Case study: Implementing data governance policies and procedures at CSE Insurance #

CSE Insurance Group is a well-known provider of property and casualty insurance across the United States, but like many other insurance companies, they faced challenges with managing their data.

Their data was siloed across various sources, making it difficult for teams to access and use the information they needed. Additionally, basic definitions and metrics were not consistent among users, causing confusion and inefficiencies. To make matters worse, CSE had to migrate their Tableau governance efforts, adding to the complexity.

To tackle these issues, CSE knew they needed a solution that could ensure data accessibility and usability for their teams.

By adopting Atlan’s data governance platform, CSE unified its data under a single source of truth. This transformation not only improved data accessibility and usability but also fostered a data-driven culture that earned the company industry recognition.

Also, watch → How CSE Insurance Cultivates a Data-Driven Culture with Atlan

This case study highlights the importance of implementing data governance policies and procedures in insurance companies. By doing so, insurance companies can streamline their data management processes, improve data accuracy and consistency, and create a more efficient and productive work environment.

Bottom line #

Data governance is indispensable for insurance companies, ensuring data quality, compliance, and efficiency while minimizing risks. With the right tools and frameworks, insurers can break down data silos, protect sensitive information, and drive innovation.

By leveraging platforms like Atlan, insurance companies can enhance their governance capabilities, which fosters collaboration, streamlines workflows, and unlocks the true potential of their data.

Data governance in insurance: Related reads #

- What is Data Governance? Its Importance, Principles & How to Get Started?

- Key Objectives of Data Governance: How Should You Think About Them?

- Data Governance Framework — Examples, Templates, Standards, Best Practices & How to Create One?

- Data Governance and Compliance: Act of Checks & Balances

- How to implement data governance? Steps, Prerequisites, Essential Factors & Business Case

- How to Improve Data Governance? Steps, Tips & Template

- 7 Steps to Simplify Data Governance for Your Entire Organization

- Snowflake Data Governance — Features, Frameworks & Best Practices

- Automated Data Governance: How Does It Help You Manage Access, Security & More at Scale?

- Enterprise Data Governance — Basics, Strategy, Key Challenges, Benefits & Best Practices

- Data Governance in Manufacturing: Steps, Challenges, and Practical Examples

- Data Governance in Retail: Best Practices, Challenges, and Viable Solutions

Share this article