Data Governance in Fintech: Core Challenges, Business Benefits, and Essential Capabilities in 2024

Share this article

Data governance in fintech ensures data is managed, secured, and used responsibly across the organization.

See How Atlan Simplifies Data Governance – Start Product Tour

This article explores how fintech companies can benefit from effective data governance, covering key regulations, business outcomes, and the essential capabilities needed for proper implementation.

Table of Contents #

- What is data governance in fintech? An overview

- Why do we need data governance in fintech? Addressing 5 pressing challenges

- What are the business benefits of data governance in fintech?

- What capabilities do you need to successfully implement data governance in fintech?

- Bottom line: Data governance in fintech fuels continued business growth and innovation

- Data governance in fintech: Related reads

What is data governance in fintech? An overview #

“The (fintech) industry needs to establish a robust data governance framework as layers in the financial services space typically hold and process large amounts of wide-ranging customer data as a core part of their business.” - PwC underlining the need for effective data governance in fintech

Data governance in fintech is a scalable way to ensure that the data captured by fintech firms remains secure, consistent, and compliant with relevant policies and regulations.

More critically, data governance empowers data-driven decision-making without compromising security or privacy.

Abraham Tom, Director of Data at Generate Capital PBC, captures this sentiment clearly:

“[Data governance] makes sure everyone that needs to be informed or that needs to make a decision has the right information to do so.”

Why do we need data governance in fintech? Addressing 5 pressing challenges #

Fintech firms generate enormous volumes of financial data at high speed and in various formats—ranging from structured transaction data to unstructured customer communication. This poses challenges in data integration, discovery, access, and analysis.

Without proper data governance in place, fintech firms expose themselves to challenges, such as:

- Siloed, inconsistent data causing data chaos

- Compliance risks leading to fines and reputational damage

- Data security, privacy, and integrity issues increasing vulnerability to cyberattacks

- Data sharing and interoperability roadblocks causing operational inefficiencies

- Missed business opportunities from poor governance

1. Siloed, inconsistent data causing data chaos #

In a large fintech firm, it’s not uncommon for data to be siloed across various systems—core banking, payment gateways, and CRM platforms—leading to inconsistencies.

Also, data silos mean it’s tough to know what data flows where and how to access it, leading to data visibility, discoverability, and access issues.

2. Compliance risks leading to fines and reputational damage #

The fintech industry is heavily regulated and as such, compliance touches every aspect of a financial product, from marketing to account closures. Non-compliance can lead to severe penalties, reputational damage, and loss of customer trust.

Robinhood Financial, for instance, was fined $70M by FINRA for misinforming customers and causing system outages during volatile market conditions.

“Compliance with these rules (that protect investors and the markets) is not optional and cannot be sacrificed for the sake of innovation or a willingness to ‘break things’ and fix them later.” - Jessica Hopper, the head of FINRA’s enforcement department

To help you get a lay of the land, here’s a quick primer on which regulatory authority oversees what in the US and the EU.

The regulatory landscape for fintech firms: Who oversees what?

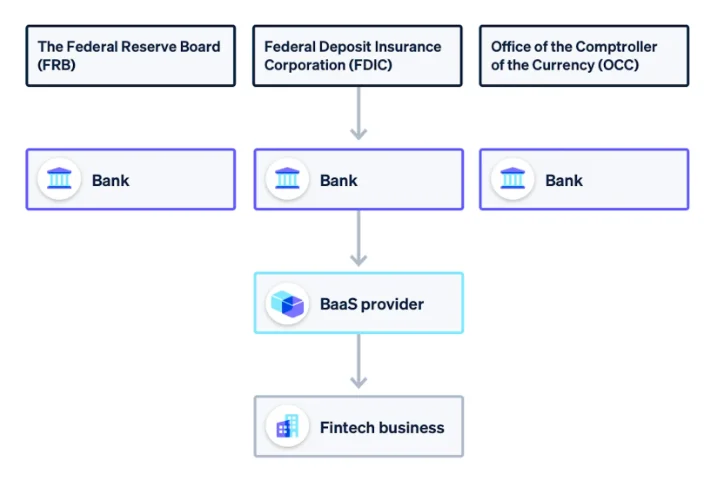

In the US, the FRB (Federal Reserve Board), the OCC (Office of the Comptroller of the Currency), and the CFPB (Consumer Financial Protection Bureau) are examples of regulators.

These bodies oversee rules and policies that all financial services firms, including fintechs, must follow.

Federal regulators overseeing compliance requirements for fintech businesses - Source: Stripe.

For example, the OCC enforces the BSA (Bank Secrecy Act), which focuses on Anti-Money Laundering (AML) compliance.

Now, if you’re a US fintech with EU-based clients, then you must also comply with the EU GDPR (General Data Protection Regulation). According to Bloomberg Law, this would include businesses that “use an EU language or currency, (offer) the ability to place orders in an EU language and (make) references to EU users/customers.”

Meanwhile, if you operate in the EU, you’re subject to the ESMA (European Securities and Markets Authority), overseeing fintech investment initiatives in the EU.

Read more → Why data governance and compliance is an act of checks and balances

3. Data security, privacy, and integrity issues increasing vulnerability to cyberattacks #

Fintech is a popular industry for cybercriminals to target, with the average cost of a breach 28% times higher than other industries, according to a 2021 report. Data breaches can stem from:

- Software vulnerabilities (Heartbleed bug in OpenSSL or the POODLE vulnerability in SSL 3.0)

- Ineffective security protocols (the DES and early SSL/TLS protocols)

- Social engineering attacks (phishing, whaling, baiting)

For instance, banking and fintech provider Evolve suffered a data breach after a phishing email exposed PII – customer names, Social Security numbers, dates of birth and account information.

Insulating from such issues is challenging for fintech companies as ensuring effective data protection can be complex. Fintechs must tailor security policies based on various factors, like the data source or customer domain. Here’s how Aniket Bhosle, Cyber Consulting Partner at EY India puts it:

“If you look at data protection, whether it is about classifying the data or encrypting the data elements or even tokenizing them, it is one of the challenges that needs to be addressed. This is complex for a fintech (to do) as different organizations that they cater to may have their own policies and control requirements.”

4. Data sharing and interoperability roadblocks leading to operational inefficiencies #

Fintechs often collaborate with banks, payment processors, and third-party vendors, each using different systems and data formats. Incompatibility between systems can lead to operational delays and errors.

For example, a fintech processing payments may need to integrate with multiple banking APIs, each with unique security protocols, formats, and compliance rules. If these systems don’t communicate effectively, it can cause delays, longer transaction times, and payment reconciliation errors.

In such an environment, data sharing is a nightmare and can lead to poor practices that increase the risk of data breaches and leaks.

5. Missed business opportunities from poor governance #

Fintech companies thrive on their ability to innovate quickly. However, you can’t unlock the full potential of data-driven innovation if you suffer from the challenges, such as siloed data, inconsistent formats, and compliance issues.

For instance, a fintech firm launching a new credit scoring service may face delays if data from multiple sources (banking, payment history, demographic data) can’t be unified due to format inconsistencies or quality gaps.

This forces the company to spend time fixing data issues, struggling with access, and navigating compliance hurdles, slowing product development cycles and stretching resources thin.

Data governance in fintech can help overcome the above challenges and drive business outcomes. Let’s see how.

What are the business benefits of data governance in fintech? #

Data governance can help fintech firms with:

- Regulatory compliance

- Data security, privacy, and integrity

- Operational efficiency

- Business growth and innovation

Let’s see how by exploring the specifics of each benefit listed above.

1. Regulatory compliance #

Effective data governance can help fintech firms automate compliance reporting, maintain auditable data trails, and oversee compliance across jurisdictions from a single location.

For example, the GDPR requires the “right to be forgotten,” allowing customers in the EU and UK to request deletion of their personal data. UK-based digital bank Tide initially handled this with a script that deleted personal data from primary databases, but manual intervention was needed for secondary systems.

“The process was not capturing data from all the new sources that kept appearing in the organization, just the key data source.” - Michal Szymanski, Data Governance Manager at Tide

The manual efforts, coupled with a lack of shared definitions of personal data, involved frequently re-litigating definitions.

By implementing proper data governance, integrating their data estate, and establishing shared definitions, Tide could automatically identify, tag, and classify data assets within hours using a single workflow.

Read more →How Tide improved GDPR compliance within hours, rather than months

2. Data security, privacy, and integrity #

Effective data governance can help fintech firms automatically classify, mask, and anonymize PII data, personalizing policies depending on the data source, domain, project, and more.

It can also support actionable, column-level end-to-end lineage tracking that maps your entire data estate automatically. This helps you gauge how a particular data asset originated and changed over time – making it possible to detect and fix data quality issues, perform root-cause and impact analysis, and ensure maximum data asset visibility.

Also, read → Automated data lineage 101

3. Operational efficiency #

Data governance brings order to what might otherwise be chaotic, siloed data environments in fintech firms, leading to smoother and more efficient operations. Centralizing data and eliminating silos simplifies data access, search, and discovery.

Clear data lineage, documenting transformations, relationships, and ownerships, provides context and reduces time spent searching for information.

For instance, Octane (Octane Lending, Inc.) used an internal Slack channel to ask questions about data, which data engineers had to resolve.

After standardizing data and ensuring easy data search and discovery, support requests dropped by 40% in three months, saving 200 engineering hours per month.

Read more → Octane Lending saves 200 hours per month of engineering effort

4. Business growth and innovation #

At the risk of sounding like a broken record, let’s state the obvious: good data can help you find growth opportunities.

Without data governance, finding the right data and then sharing it with the right people is a challenge. Leroy Kahn, Data Management Lead at Zip, a digital financial services company, echoes the sentiment.

Zip was modernizing its data stack to drive profitable growth. The company tied this business goal to a data-related outcome — improve data consumption by 20%.

“Our Data & Analytics teams and data users were finding it difficult to quickly, reliably, and easily share, find, understand, and use data to really unlock the value of our data platform and our data products.” - Leroy Kahn, Data Management Lead at Zip

By adopting Atlan’s active data governance platform, Zip achieved its goal, driving cost savings and better decision-making, with a projected $390,000 in business value.

Good governance also enables automation and AI, as AI models rely on high-quality data. Without it, issues like bias and privacy violations can undermine AI systems’ effectiveness and trustworthiness.

Also, read → Data readiness for AI

What capabilities do you need to successfully implement data governance in fintech? #

Data governance can drive business outcomes – save non-compliance fines, improve efficiency, drive innovation and growth, etc.

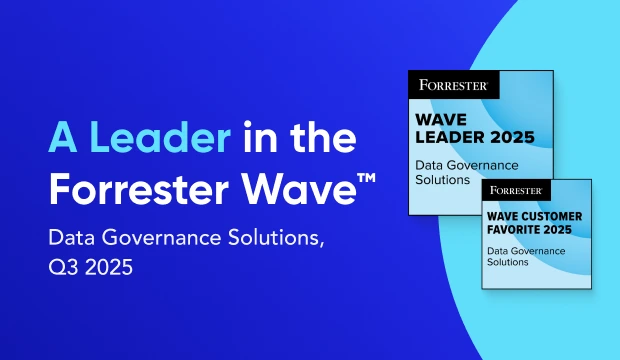

Ensuring these outcomes requires adopting technology with capabilities outlined by the latest Forrester Wave™ report for enterprise data catalogs. These include (but aren’t limited to):

- Data governance, risk, and compliance

- AI-assisted policy and process management

- Data contracts that embed governance guardrails into the data producer tools and workflows

- Built-in support for risk assessment and regulations (GDPR, HIPAA, CCPA)

- Ways to measure and communicate data governance, risk, compliance

- Metadata management

- Auto-ingestion and capture of metadata

- Metadata augmentation

- Automatic update and sync of metadata changes across your data estate

- Classification and tagging (propagated via lineage) at scale

- Data lineage

- Automated data lineage mapping (granularity down to columns, transformations, and tables across systems)

- Support for impact and root-cause analysis

- An intuitive lineage UI that enables actions (explore, filter, search, navigate)

- Data privacy and security

- A central location to review policy coverage (top-down) across the data estate

- Support for data access controls (RBAC, ABAC, IAM, etc.) and policies

- Audit trails and reports

- Incident alerts in real-time (as and when they happen)

- Integration and collaboration capabilities

- Out-of-the-box connectors for data products in your data stack (data sources, data movement tools, BI tools, etc.)

- Data sharing via your favorite data tools

- Collaboration capabilities (threads, comments, alerts, mentions, user tagging)

- Ease of deployment

- Support for on-premise, public cloud, SaaS, multi-cloud, etc.

- Quick and seamless adoption (look for the median timeline from kickoff to go-live)

- Faster time-to-value (with unique accelerators, capabilities, or contents)

Read more → How enterprise business catalogs support data governance and drive business value

Bottom line: Data governance in fintech fuels continued business growth and innovation #

Data governance in fintech goes beyond compliance—it’s about achieving operational efficiency, ensuring data security, and driving innovation.

By addressing the above challenges, data governance enables fintech firms to operate more efficiently, reduce operational risks, and improve customer trust.

Data governance in fintech: Related reads #

- Data Governance in Action: Community-Centered and Personalized

- Data Governance Framework — Examples, Templates, Standards, Best practices & How to Create One?

- Data Governance Tools: Importance, Key Capabilities, Trends, and Deployment Options

- Data Governance Tools Comparison: How to Select the Best

- Data Governance Tools Cost: What’s The Actual Price?

- Data Governance Process: Why Your Business Can’t Succeed Without It

- Data Governance and Compliance: Act of Checks & Balances

- Data Governance vs Data Compliance: Nah, They Aren’t The Same!

- Data Compliance Management: Concept, Components, Getting Started

- Data Governance for AI: Challenges & Best Practices

- A Guide to Gartner Data Governance Research: Market Guides, Hype Cycles, and Peer Reviews

- Gartner Data Governance Maturity Model: What It Is, How It Works

- Data Governance Roles and Responsibilities: A Round-Up

- Data Governance in Banking: Benefits, Implementation, Challenges, and Best Practices

- Data Governance Maturity Model: A Roadmap to Optimizing Your Data Initiatives and Driving Business Value

- Open Source Data Governance - 7 Best Tools to Consider in 2024

- Federated Data Governance: Principles, Benefits, Setup

- Data Governance Committee 101: When Do You Need One?

- Data Governance for Healthcare: Challenges, Benefits, Core Capabilities, and Implementation

- Data Governance in Hospitality: Challenges, Benefits, Core Capabilities, and Implementation

- 10 Steps to Achieve HIPAA Compliance With Data Governance

- Snowflake Data Governance — Features, Frameworks & Best practices

- Data Governance Policy: Examples, Templates & How to Write One

- 7 Best Practices for Data Governance to Follow in 2024

- Benefits of Data Governance: 4 Ways It Helps Build Great Data Teams

- Key Objectives of Data Governance: How Should You Think About Them?

- The 3 Principles of Data Governance: Pillars of a Modern Data Culture

Share this article